The Secrets Behind compound price prediction: What You Need To Know

If you’re an investor, chances are you’ve heard of compound price prediction. This is the idea that investors can accurately predict how prices of certain assets will change over time based on certain data points. But what exactly are these data points? How do they influence pricing? What’s the best way to use them to make accurate predictions? In this article, we’ll explain the main drivers behind and how you can use them to your advantage. Read on to learn more about this fundamental concept and further your knowledge of investing in the process.

Basic concepts of compound price prediction

There are a few basic concepts that you need to know in order to make an accurate price prediction for compound. The first concept is supply and demand. The amount of compound price prediction that is available on the market will influence the price. If there is high demand for compound but low supply, the price will go up. On the other hand, if there is low demand and high supply, the price will go down.

The second concept is the time frame that you are predicting for. The longer the time frame, the more difficult it is to predict accurately. This is because there are more factors that can influence the price over a longer period of time.

The third concept is market trends. You need to be aware of any overall trends in the market before making your prediction. For example, if there has been a general trend of prices going up over the past few months, it is likely that this trend will continue into the future.

By taking into account all of these factors, you can make a much more accurate prediction for compound prices.

The secrets behind compound price

What You Need to know

when it comes to predicting the price of a compound, there are a few key factors that you need to take into account. In this article, we’ll reveal the secrets behind compound price, so that you can make more informed decisions when investing in this cryptocurrency.

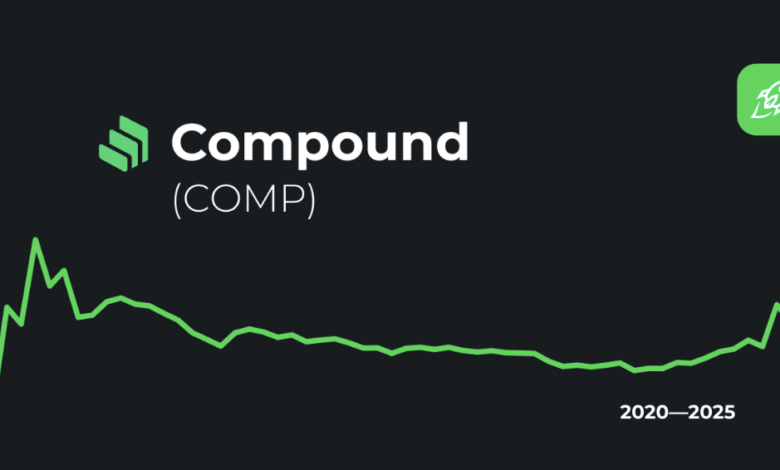

1. Look at the historical data

One of the best ways to predict the future price of a compound is to look at its historical data. This will give you an idea of how the price has fluctuated in the past, and what kind of factors have influenced these changes.

2. Take into account the current market conditions

It’s also important to take into account the current market conditions when predicting the future price of a compound. This includes things like the overall demand for cryptocurrency, as well as any news or events that could impact the price.

3. Use technical analysis

Technical analysis is another helpful tool that you can use to predict the future price of a compound. This involves looking at things like chart patterns and indicators to try and identify where the price is headed next.

4. Use fundamental analysis

In addition to technical analysis, you can also use fundamental analysis to predict the future price of a compound. This approach looks at things like the project’s roadmap, team, and partnerships to try and gauge its long-term potential.

How to use compound prediction

If you’re looking to get ahead of the curve in terms of compound prediction, there are a few key things you need to know. First and foremost, it’s important to monitor the market conditions leading up to the release of a new product or service. This will give you a good idea as to whether or not there is pent-up demand for the offering. Additionally, pay close attention to competitor pricing – if they are significantly cheaper than you, it may be difficult to win market share.

Once you have a good understanding of the market landscape, it’s time to start working on your own predictions. There are a number of different methods you can use, but one of the most effective is regression analysis. This technique involves using historical data points to create a mathematical model that can then be used to predict future outcomes. If done correctly, regression analysis can be incredibly accurate – making it a valuable tool for any business looking to stay ahead of the competition. Read more…

Conclusion

Investing in the stock market can be a great way to make money, but predicting which companies will perform well is not always easy. However, with the right knowledge and tools available to investors, they can use compound price prediction strategies to give themselves an edge over other investors. By understanding the basics of how these predictions work, as outlined in this article, you can increase your chances of success when investing in stocks. With some practice and dedication, anyone has the potential to become a successful investor!